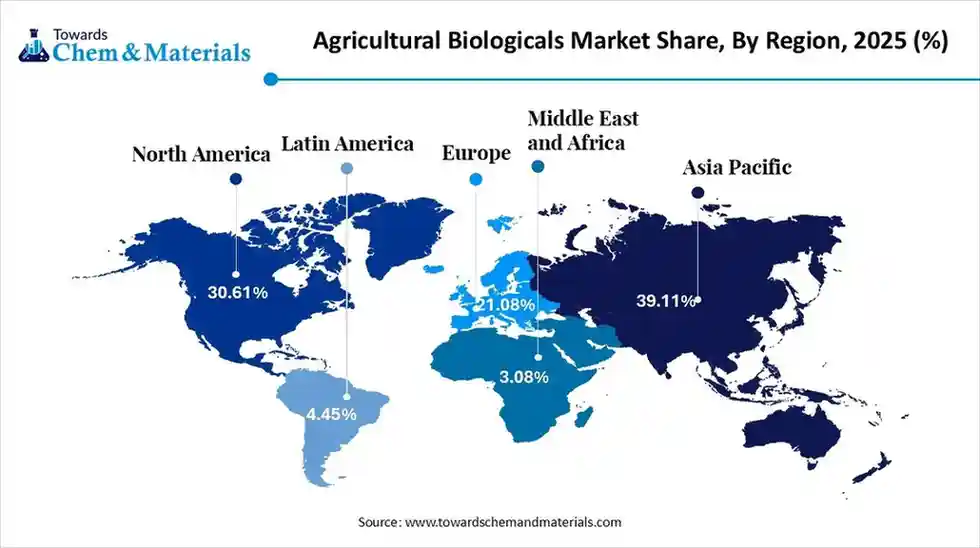

Ottawa, Dec. 05, 2025 (GLOBE NEWSWIRE) -- The global agricultural biologicals market size reached at USD 18.85 billion in 2025 and is predicted to increase by USD 21.44 billion in 2026 and is expected to be worth around USD 68.36 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 13.75% over the forecast period 2026 to 2035. Asia Pacific dominated the agricultural biologicals market with a market share of 39.11% the global market in 2025. The growing demand for sustainable and eco-friendly farming solutions is driving the agricultural biologicals market. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/6044

What are Agricultural Biologicals?

The agricultural biologicals market is expanding rapidly as farmers move towards eco-friendly crop protection and enhancement solutions. It includes products such as biopesticides, biofertilizers, and biostimulants that support sustainable farming practices. Growth is driven by rising environmental concerns, tighter regulations on synthetic chemicals, and the global shift to organic agriculture. Increasing focus on soil health and crop resilience is further pushing demand for biological alternatives. Advances in microbial technologies and collaborations between biotech firms and agrochemical companies are accelerating innovation.

Request Research Report Built Around Your Goals: sales@towardschemandmaterials.com

Agricultural Biologicals Market Report Highlights

- Asia Pacific dominated the agricultural biologicals market with the largest revenue share of over 39.11% in 2025.

- By product type, the biopesticides segment held the largest revenue share of 46.11% in 2025 in terms of value.

- By crop type, the cereals & grains segment led the market with the largest revenue share of 41.07% in 2025.

- By mode of application, the foliar spray segment led the market with the largest revenue share of 43.77% in 2025.

- By formulation type, the liquid segment accounted for the largest revenue share of 49.14% in 2025.

- By origin, the microbial-based segment dominated with the largest revenue share of 56.32% in 2025.

- By farming type, the conventional farming segment dominated the market and accounted for the largest revenue share of 66.22% in 2025.

What are the key benefits of biologicals in agriculture?

- Sustainability: Biologicals are an essential tool in sustainable agriculture. They are a functional component to an effective Integrated Pest Management (IPM)strategy and contribute to environmentally responsible production systems.

- Crop Yield and Quality: Biologicals help improve crop yields and quality. This helps growers deliver healthy and affordable feed and food products to consumers around the world. Biologicals help with resistance management because of their different modes of action which results in increased yields and farm profitability over the long term.

- Flexibility in Spray Programs: Biologicals offer growers convenience and flexibility in spray timing due to short re-entry (REI) and pre-harvest intervals (PHIs). Short re-entry means that farmers can go into the field or greenhouse immediately or within a short period after a biological crop protection product application. Short PHIs refer to the wait time between application and harvest. Having short ones allow harvest and shipping schedules to be better maintained. Growers can also more easily manage the differences in residue requirements when getting their products to the food value chain.

- Residue Management: Biologicals typically do not linger in the environment. Since they rapidly degrade, possible harmful exposure risk to humans and the environment is reduced. Biological products are often exempted from Maximum Residue Limits (MRLs) – helping to improve the global marketability of crops treated with biologicals.

- Resistance Management: An Integrated Pest Management (IPM) strategy that combines biological, genetic and chemical crop protection products will utilize multiple modes of action and provide a sustainable approach to the management of resistance.

Why are biologicals important?

Both global food consumption and the demand for more complex food are constantly growing. Food production needs to increase by 50% by 2050 – and it falls to farmers to deliver, despite increasing stresses from climate change.

Farmers must have new, sustainable technologies to increase crop productivity despite multiple challenges. Extreme weather, water scarcity, resistant pests and diseases increasingly cause crop losses. Up to 30% of global production of the major staple crops of wheat, rice, maize, potato, and soybean is lost. Up to 70% of yield losses in major crops are lost due to adverse environmental conditions.

Growers are adopting regenerative agriculture practices and leveraging data, digital apps and precision agriculture – but these are not enough. This is where biologicals contribute to filling the gap – offering farmers more flexibility and a richer choice of tools, all of which support reaching productivity and sustainability goals.

How do biologicals support regenerative agriculture?

Farmers are increasingly adopting regenerative to nurture and restore soil health, protect the climate, water resources and biodiversity, and increase productivity and profitability. Biologicals play a part, supporting farmers to use natural resources, like water, and farm resources, like inputs, more efficiently. As they increase yields, biologicals prevent the expansion of farmland.

Biologicals are applied precisely, and have a low impact on the surrounding environment, protecting biodiversity. They contribute to healthier soils, improving soil’s ability to retain scarce water and to capture and store more carbon, reducing the greenhouse gas emissions from agriculture.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6044

Agricultural Biologicals Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 21.44 billion |

| Revenue forecast in 2035 | USD 68.36 billion |

| Growth Rate | CAGR of 13.75% from 2026 to 2035 |

| Historical data | 2018 - 2025 |

| Forecast period | 2025 - 2035 |

| Quantitative units | Volume in Kilotons, Revenue in USD Billion and CAGR from 2025 to 2035 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Product Type, By Crop Type, By Mode of Application, By Formulation Type, By Origin, By Farming Type, By Region |

| Regional scope | North America, Europe, Asia Pacific, Central & South America, Middle East Africa |

| Country scope | U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; South Africa, Saudi Arabia |

| Key companies profiled | CBF China Biofertilizer AG; Novozymes A/S; Mapleton Agri Biotec; biomax; Rizobacter Argentina SA; Symborg S.L.; National Fertilizers Ltd; Lallemand Inc; Agricen; Sigma Agri-Science, LLC; Agrinos Inc.; Kiwa Bio-Tech Products Group Corporation. |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

AI Revolution: Powering the Next Era of Agricultural Biologicals

AI is revolutionizing the agricultural biologicals industry by accelerating product development, enhancing field performance, and improving commercial scalability. Advanced machine learning models now enable researchers to screen thousands of microbial strains virtually, dramatically reducing the time and cost required to identify the most effective candidates for biopesticides, biostimulants, and biofertilizers. AI-driven field analytics, using drones, sensors, and satellite data, allow farmers to apply biological inputs with pinpoint accuracy, minimizing waste and maximizing crop response.

Government Initiatives for the Agricultural Biologicals Industry:

- Paramparagat Krishi Vikas Yojana (PKVY): This Indian scheme promotes organic farming and the use of organic inputs, including biofertilizers, by providing financial assistance and encouraging a cluster approach for certification and marketing.

- EU Farm-to-Fork Strategy: This European Union initiative aims to reduce chemical pesticide use by 50% and fertilizer use by at least 20% by 2030, creating a significant market push for biological alternatives.

- USDA Organic Transition Initiative: The U.S. Department of Agriculture provides over $300 million in funding for technical assistance and capacity building to farmers transitioning to organic production, where agricultural biologicals are a natural fit.

- National Mission on Natural Farming (NMNF): India's NMNF focuses on promoting chemical-free, natural farming practices, which includes the establishment of bio-input resource centers and support for farmer training.

- EU Fertilising Products Regulation (EU FPR) 2019/1009: This regulation harmonizes standards for bio-based fertilizers and biostimulants across EU member states, allowing for easier market access and cross-border trade (CE-marking).

- PM Programme for Restoration, Awareness, Nourishment, and Amelioration of Mother Earth (PM-PRANAM): This Indian program incentivizes states to reduce chemical fertilizer consumption by providing them with 50% of the saved fertilizer subsidy to promote organic and bio-fertilizers.

- EPA Biopesticide Regulatory Support: The U.S. Environmental Protection Agency (EPA) has a streamlined, fast-track process for registering biopesticides, encouraging innovation and quicker market entry for these products.

- Formation & Promotion of 10,000 Farmer Producer Organizations (FPOs): This Indian scheme provides financial assistance and professional support to FPOs, which can help aggregate demand and facilitate the supply chain for biological inputs and organic produce.

Key Trends of the Agricultural Biologicals Market

- Growing Demand for Organic and Sustainable Farming: Consumers are increasingly concerned about health, food safety, and environmental impacts, leading to a rising preference for organic and residue-free produce. This shift drives farmers to adopt biological solutions, such as biopesticides and biofertilizers, which are compatible with organic certification and help improve soil health and biodiversity.

- Advancements in Technology and Precision Agriculture Integration: Innovations in microbial research, biotechnology, and formulation technologies are enhancing the efficacy, stability, and application methods of biological products. The integration of these biologicals with precision farming technologies, like artificial intelligence (AI), sensors, and drones, allows for targeted and efficient application, optimizing resource use and maximizing crop yields.

Market Opportunity

Biological Seed Treatments: The Fastest-Growing Opportunity in Agricultural Biologicals

A major opportunity in the agricultural biologicals market lies in the rapid expansion of biological seed treatments, driven by the need for stronger early-stage crop protection and growth enhancement. Farmers are increasingly adopting microbe-based coatings that boost germination, improve nutrient uptake, and enhance stress tolerance. These treatments offer a low-application, high-impact solution that aligns with global sustainability goals and regulatory pressures against chemical seed treatments. Advancements in microbial formulation technologies are improving shelf life and stability, making these products more commercially viable.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6044

Agricultural Biologicals Market Segmentation Insights

Product Type Insights

In 2025, the biopesticides segment dominated the market due to increasing demand for sustainable and eco-friendly pest control solutions that reduce reliance on chemical pesticides. Farmers adopted microbial, botanical, and bioinsecticidal products to effectively manage pests and diseases while maintaining crop safety and minimizing environmental impact. Stricter government regulations and residue limits on synthetic pesticides further accelerated the shift towards biopesticides.

The biostimulants segment is expected to grow fastest over the forecast period due to growing demand for products that enhance crop growth, stress tolerance, and nutrient-use efficiency without relying on synthetic fertilizers. Farmers increasingly used biostimulants, such as seaweed extracts, humic acids, and protein hydrolysates, to improve root development, flowering, and overall plant vigor. Rising awareness of sustainable agriculture and regulatory support for eco-friendly inputs further boosted adoption.

Crop Type Insights

The cereals & grains segment dominated the market in 2025 because these crops account for the largest share of global farmland, creating high demand for yield-enhancing and soil-improving biological inputs. Farmers increasingly adopted biofertilizers and biostimulants to boost nutrient uptake in staples like wheat, rice, and corn, where productivity gains have significant economic impact. Rising pressure to reduce chemical residues in widely consumed foods also encouraged the shift towards biological pest and disease management.

The fruit & vegetable segment is growing fastest over the forecast period because these crops are highly sensitive to pests, diseases, and nutrient deficiencies, making biological inputs essential for healthy growth. Farmers increasingly relied on biopesticides, biofertilizers, and biostimulants to enhance yield, improve quality, and reduce chemical residues in perishable produce. High-value crops such as tomatoes, grapes, and citrus benefited from precise, targeted applications of microbial and plant-based biologicals.

Mode of Application Insights

The foliar spray segment dominated the market in 2025 because it offered faster nutrient absorption and quicker visible results compared to soil-based applications. Foliar spraying allows biologicals, such as bio stimulants, biofertilizers, and biopesticides, to be absorbed directly through the leaves, improving plant stress tolerance and boosting growth efficiency.

The seed treatment segment is growing fastest over the forecast period because it provided highly targeted delivery of microbes and plant-derived compounds directly at the seed level, ensuring stronger early-stage crop establishment. Seed-applied biologicals improved germination, root development, and seedling vigor, resulting in higher yields with minimal input use. This method also reduces application costs and labor, making it attractive for large-scale farming.

Formulation Type Insights

The liquid segment led the market in 2025 largely due to its superior ease of application, higher compatibility with modern farming systems, and stronger product performance. Liquid formulations mix easily with irrigation systems, foliar sprays, and fertigation setups, making them ideal for large-scale and precision agriculture. They also offer better microbial viability and uniform distribution compared to dry forms, improving field-level effectiveness.

The dry/granular segment is projected for the fastest growth in the forecast period due to its superior storage stability, longer shelf life, and ease of handling compared to liquid formulations. These products are less sensitive to temperature fluctuations, making them ideal for regions with limited cold-chain infrastructure. Granular biologicals are also preferred for soil applications because they release active ingredients slowly and consistently, improving root-zone effectiveness.

Origin Insights

In 2025, the microbial-based segment led the market because of its strong effectiveness in improving soil fertility, enhancing nutrient uptake, and providing natural pest and disease control. Microbial products such as beneficial bacteria, fungi, and microbial consortia offer targeted solutions that work in harmony with plant biology, making them more reliable than many biochemical alternatives. Growing demand for sustainable farming practices and reduced chemical use further boosted adoption, as microbes help restore soil health and reduce residue levels.

The plant-based segment is the second-largest segment, leading the market due to its strong acceptance as a safe, residue-free, and eco-friendly alternative to synthetic agrochemicals. Plant-derived biostimulants and biopesticides gained traction because they are fast-acting, compatible with organic farming, and effective across a wide range of crops. Their naturally occurring compounds, such as botanical extracts, essential oils, and plant peptides, offer reliable pest control and stress tolerance without harming beneficial organisms.

Farming Type Insights

In 2025, the conventional farming segment led the market because large-scale farmers increasingly integrated biologicals alongside traditional chemical inputs to improve soil health and crop resilience. Biological products offered complementary benefits, such as enhanced nutrient uptake and pest suppression, that boosted overall yield performance in intensive farming systems. Widespread availability, lower application costs, and compatibility with existing equipment made biologicals easy to adopt without altering conventional practices.

The organic farming segment is expected to grow fastest over the forecast period because biological inputs are essential for meeting organic certification standards and replacing synthetic fertilizers and pesticides. Farmers in this segment rely heavily on biopesticides, biofertilizers, and biostimulants to maintain soil fertility, manage pests naturally, and support resilient crop growth. Rising consumer demand for organic, residue-free food further expanded organic cultivation areas, increasing the need for biological inputs.

Regional Insights

Asia Pacific: The Dominant Region in Agriculture Biologicals Market

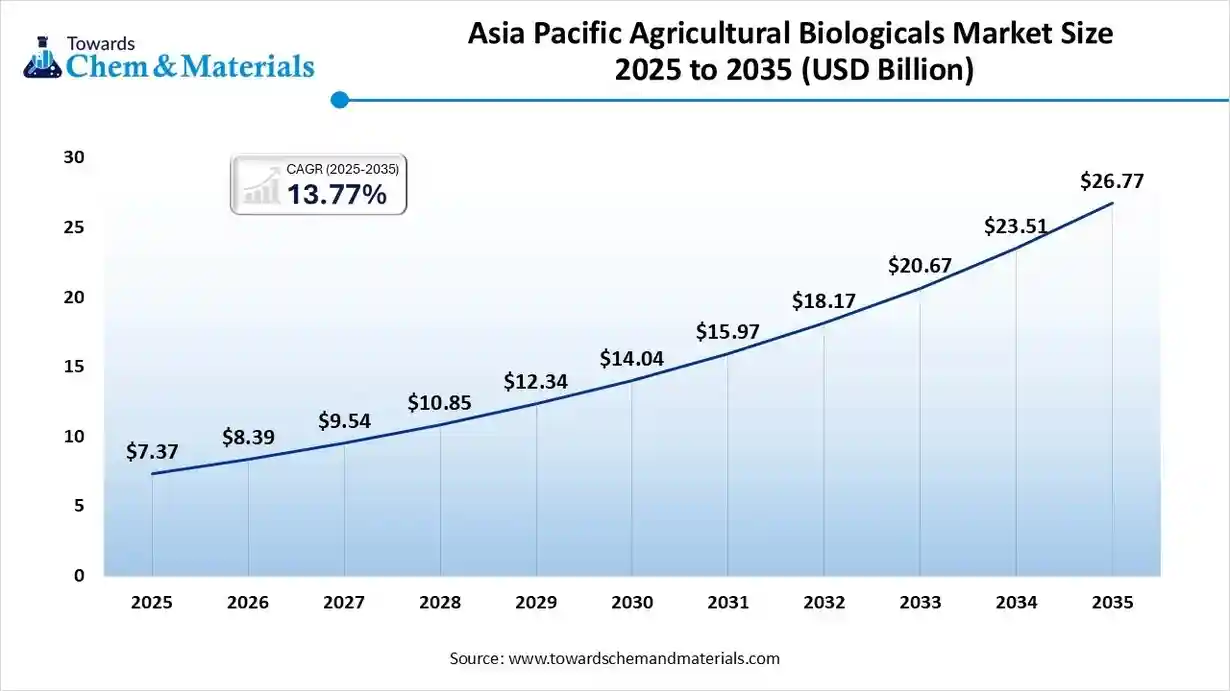

The Asia Pacific agricultural biologicals market size was valued at USD 7.37 billion in 2025 and is expected to reach USD 26.77 billion by 2035, growing at a CAGR of 13.77% from 2026 to 2035. Asia Pacific dominated the market with approximately 39.11% share in 2025.

Asia Pacific is emerging as the dominant force in the market, driven by its vast agricultural base and rapidly expanding demand for sustainable farming solutions. Countries like India, China, and Indonesia are adopting biopesticides and biofertilizers at scale as farmers shift away from synthetic chemicals. Government-led sustainability programs and subsidies are accelerating the transition towards eco-friendly inputs across major crop sectors. Strong growth in organic farming and regenerative agriculture is further boosting adoption of microbial and biostimulant products.

India Agriculture Biologicals Market Trends

The Indian Market is growing rapidly as farmers increasingly shift towards eco-friendly inputs to improve soil health and reduce chemical dependency. Rising demand for biopesticides, biofertilizers, and biostimulants is driven by stricter regulations on synthetic chemicals and the expanding organic farming sector. Government programs promoting sustainable agriculture and micro-irrigation are further accelerating adoption of biological solutions.

Latin America: The Fastest-Rising Frontier in Agriculture Biologicals Market

Latin America is experiencing the fastest growth in the market, driven by its large-scale commercial farming and strong demand for residue-free crop solutions. Countries like Brazil, Argentina, and Chile are rapidly adopting biopesticides and biostimulants to improve soil health and reduce dependence on chemical inputs. Regional regulators are supporting biological alternatives through streamlined approvals and sustainability-focused policies. The region's expanding organic farming acreage is further accelerating the shift towards microbial and natural-compound products.

Brazil Agriculture Biologicals Market Trends

Brazil’s Market is expanding rapidly as large-scale farmers adopt biopesticides and biostimulants to reduce chemical residues and improve soil health. Strong government support, including faster regulatory approvals for biologicals, is accelerating market penetration. Growing export pressures, especially for soybeans, fruits, and vegetables, are pushing producers toward sustainable, residue-free crop inputs.

Top Companies in the Agricultural Biologicals Market & Their Offerings:

- Symborg S.L.: Develops biostimulants and biofertilizers that use natural processes to enhance nutrient efficiency and improve crop stress tolerance.

- National Fertilizers Ltd.: A major Indian producer, the company manufactures and markets standard bio-fertilizers like Rhizobium and PSB to promote integrated nutrient management.

- Lallemand Inc.: Provides a broad portfolio of microorganism-based solutions, including biofertilization, biocontrol, and biostimulation products, to support sustainable agriculture.

- Agricen: Develops biochemical-based biological and biostimulant solutions designed to improve nutrient availability, enhance plant health, and mitigate crop stress.

- Sigma Agri-Science, LLC: Specializes in developing organic biofertilizers and liquid biostimulants that use beneficial microbes to improve soil health and nutrient uptake.

- Agrinos Inc.: Produces biological crop inputs designed to improve crop productivity, enhance soil health, and increase the efficiency of nutrient use.

- Kiwa Bio-Tech Products Group Corporation: Involved in developing and applying microbial technology for agriculture, producing biofertilizers and related products.

- Zebra Medical Vision, Inc.: Operates in the healthcare industry, using AI for medical imaging diagnostics, and has no offerings in agricultural biologics.

More Insights in Towards Chemical and Materials:

- GNSS in Agricultural Market ; The global GNSS in agricultural market is projected to grow from USD 48.74 billion in 2025 to USD 173.67 billion by 2035, growing at a compound annual growth rate (CAGR) of 13.55% over the forecast period from 2025 to 2035.

- Agricultural Enzymes Market : The global agricultural enzymes market size was valued at USD 619.13 million in 2024. The market is projected to grow from USD 675.53 million in 2025 to USD 1480.56 million by 2034, exhibiting a CAGR of 9.11% during the forecast period.

- Agricultural Fumigants Market : The global agricultural fumigants market volume was accounted for 350.21 Kilo Tons in 2024 and is expected to be worth around 540.34 Kilo Tons by 2034, growing at a compound annual growth rate (CAGR) of 4.43% during the forecast period 2025 to 2034.

- Regenerative Agriculture Market : The global regenerative agriculture market size accounted for USD 12.95 billion in 2024 and is predicted to increase from USD 15.38 billion in 2025 to approximately USD 72.21 billion by 2034, expanding at a CAGR of 18.75% from 2025 to 2034.

- Agricultural Enzymes Market : The global agricultural fumigants market volume was accounted for 350.21 Kilo Tons in 2024 and is expected to be worth around 540.34 Kilo Tons by 2034, growing at a compound annual growth rate (CAGR) of 4.43% during the forecast period 2025 to 2034..

Agricultural Biologicals Market Top Key Companies:

- CBF China Bio-Fertilizer AG

- Novozymes A/S

- Mapleton Agri Biotec

- Biomax

- Rizobacter Argentina SA

- Symborg S.L.

- National Fertilizers Ltd.

- Lallemand Inc.

- Agricen

- Sigma Agri-Science, LLC

- Agrinos Inc.

- Kiwa Bio-Tech Products Group Corporation

- Zebra Medical Vision, Inc.

Recent Developments

Recent Breakthrough in the Agricultural Biologicals Industry:

In May 2025, Syngenta opened a novel biologicals production facility in Orangeburg, designed for producing up to 16,000 tons of plant biostimulants annually. The opening marks a significant investment in sustainable agriculture and local economic development.

Agricultural Biologicals Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Agricultural Biologicals Market

By Product Type

- Biopesticides

- Bioinsecticides

- Biofungicides

- Bionematicides

- Biofertilizers

- Nitrogen-Fixing Microorganisms

- Phosphate-Solubilizing Microorganisms

- Biostimulants

- Humic & Fulvic Acids

- Seaweed Extracts

- Beneficial Insects

By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Turf & Ornamentals

- Plantations & Cash Crops

By Mode of Application

- Foliar Spray

- Soil Treatment

- Seed Treatment

- Post-Harvest Treatment

By Formulation Type

- Liquid

- Dry / Granular

- Powder

By Origin

- Microbial-Based

- Plant-Based

- Animal-Based

By Farming Type

- Conventional Farming

- Organic Farming

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/6044

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/